In an increasingly interconnected world, the need for efficient and cost-effective banking options is pressing, especially for expatriates and migrants. About 60% of consumers say they are very or somewhat interested in using a digital bank in the next year, highlighting a significant trend. This blog explores how cryptocurrencies, in the context of changing global dynamics like the BRICS nations’ exploration of a common currency, could fulfil this need.

The Current Landscape and Consumer Preferences

The landscape of digital banking is experiencing a seismic shift, and millennials are spearheading this change. While it was previously noted that 79.3% of millennials and 33.8% of baby boomers were showing interest in digital banking, the momentum has only intensified, influenced by growing trends in digital payments. The total transaction value in the Digital Payments market is set to soar to an astounding US$9.46 trillion in 2023. With an expected annual growth rate of 11.80% from 2023 to 2027, this value is projected to rise further to US$14.78 trillion by 2027. The juggernaut of this market is Digital Commerce, which alone is expected to account for US$6.03 trillion in transaction value in 2023. Internationally, China leads in the highest cumulated transaction value, estimated to be US$3,639.00 billion in 2023. Despite this rapid digitization, traditional branches are not yet obsolete—nearly 80% of those who prefer online or mobile banking still visited a branch in 2019. About 27% of Americans are users of online-only banks, and among these, satisfaction levels are high at 88%, compared to 66% for traditional banks.

This data underscores the evolving preferences and demonstrates the enormous scale at which digital transactions are being adopted, making it a crucial consideration for financial policies, especially those concerning expatriates and migrants.

What is a Crypto Wallet?

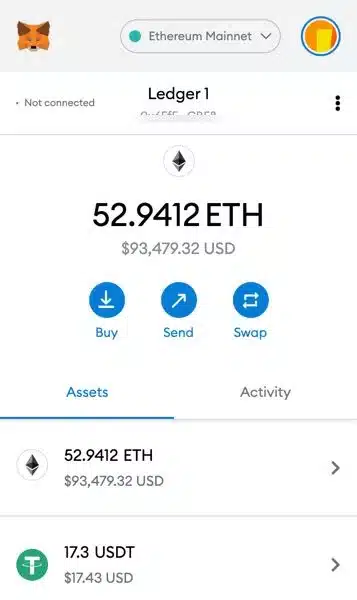

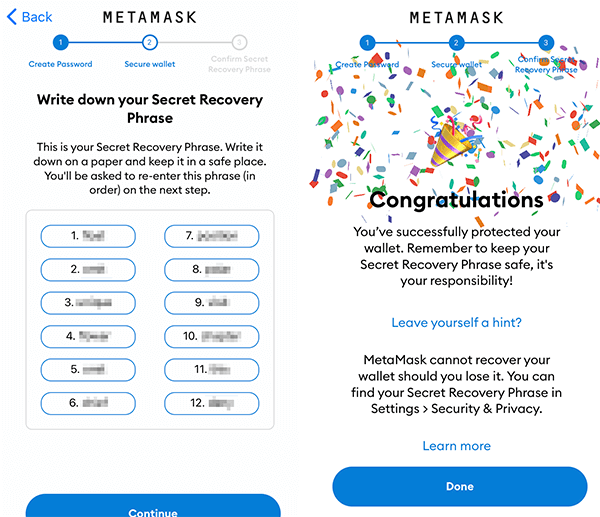

A crypto wallet goes beyond being just a digital “savings account” for your cryptocurrencies. It operates using a pair of cryptographic keys: the private key and the public key.

Private Keys: This is your digital signature and control mechanism for your assets. It’s a long, secure code that you must keep private. Losing this key means losing your assets, an especially sensitive matter for expatriates and migrants who may rely heavily on these funds.

Public Keys and Wallet Addresses: Your public key is transformed into a wallet address, the ID you share to receive funds. This keeps transactions secure as operations require the corresponding private key for execution.

Transacting Between Wallets: When you send cryptocurrencies, you use the recipient’s wallet address and authorize the transaction with your private key. These transactions are verified and added to the blockchain. For expatriates and migrants, this offers a rapid, low-cost method for international money transfer, often processed within minutes.

The Role of Decentralized Finance (DeFi) in Digital Banking

One emerging trend in the cryptocurrency space that holds significant promise for expatriates and migrants is Decentralized Finance, commonly known as DeFi. Unlike traditional financial systems, DeFi operates without a central authority, such as a bank or financial institution, and is built on blockchain technology. This decentralized nature could serve as an equalizer in the financial world, removing the need for intermediaries and potentially lowering costs even further than standard cryptocurrencies.

DeFi platforms offer a range of financial services from lending and borrowing to asset trading, all of which are facilitated through smart contracts on a blockchain. These smart contracts are self-executing contracts with the terms directly written into lines of code, which allows for trustless transactions. What this means for expatriates and migrants is the ability to access financial services without the need for a traditional bank account, credit history, or even identification in some cases.

Furthermore, DeFi protocols can provide higher interest rates for savings and lower interest rates for loans, offering a competitive alternative to traditional banking. The absence of intermediaries translates to lower operational costs, savings which are often passed on to the consumer.

However, it’s crucial to note that DeFi is not without its challenges. The absence of a central authority means that there’s often limited recourse in cases of fraud or technical failures. Additionally, the regulatory landscape for DeFi is still evolving, which introduces an element of uncertainty for users.

For expatriates and migrants, who often face challenges such as high fees for international transfers and limited access to financial services, DeFi can offer more freedom and financial autonomy. However, the potential risks must be understood and navigated carefully.

The Case for Cryptocurrency in Digital Banking

Cryptocurrencies could address some primary concerns for those interested in digital banking. For example, 33% are looking for lower costs—a feature that many cryptocurrencies offer due to reduced transaction fees. For expatriates and migrants, cryptocurrencies like Ripple’s XRP offer rapid, low-cost international transfers, which could be a game-changer.

Greater Control Over Personal Finances

One of the unique advantages of cryptocurrencies and digital wallets is the enhanced control they offer to users over their personal finances. Traditional banking systems often impose various limitations and fees, which can be especially cumbersome for expatriates and migrants. For instance, banks may restrict the amounts that can be withdrawn within a given timeframe, charge exorbitant fees for international transfers, or even freeze accounts due to suspected unusual activity.

Cryptocurrencies operate on decentralized networks, meaning that individuals have complete control over their assets without the need for a central authority. This freedom allows for unrestricted access to one’s funds 24/7, providing an invaluable advantage for those who may need to make immediate financial decisions or transactions, irrespective of their geographical location or time zone.

Additionally, because cryptocurrencies rely on a system of public and private keys, only the individual with access to the correct private key can initiate a transaction. This level of personal control offers a heightened sense of financial security, reducing the risks associated with centralized systems that could be prone to hacking, human error, or institutional failure.

For expatriates and migrants, the ability to move funds freely, without the constraints or fees imposed by traditional banks, is not just a matter of convenience but can significantly impact their financial well-being and the ease with which they can manage cross-border financial responsibilities.

Challenges and the Global Context

Recent developments from the BRICS nations indicate a shift towards multi-currency systems, potentially reducing reliance on the U.S. dollar. While promising, there are trade imbalances and regulatory complexities to consider. However, the potential for cryptocurrencies like XRP to integrate into such new systems could provide more stable, low-cost options for international transactions.

Inclusion and Accessibility

Around 5% of Americans are unbanked, meaning they have no bank accounts. The advent of digital banks and cryptocurrencies could provide these populations with easier access to financial services. Moreover, 37% of consumers say no or low monthly fees are the most important feature they look for in a checking account—something that cryptocurrencies are well-positioned to offer.

As we navigate through monumental shifts in technology and global financial policy, digital banking is rapidly ascending as a cornerstone of our financial ecosystem. With 27% of Americans already satisfied with online-only banks and a growing millennial interest, the trend is unmistakable. Cryptocurrencies not only offer advantages like lower costs and efficient transfers but also provide an unparalleled level of control over one’s personal finances. This feature is particularly important for expatriates and migrants, who often face restrictions and high fees in traditional banking systems. By integrating cryptocurrencies into digital banking solutions, there is significant potential to make financial systems more inclusive, flexible, and equitable. As the world continues to explore multi-currency systems and decentralized finance, cryptocurrencies stand to offer promising solutions, especially for those who have often been marginalized by the limitations of conventional financial institutions.